What is Fleet insurance Claims experience?

Fleet insurance is the easiest of insurance policies to let stagnate – the reason being that before you can obtain a quotation from alternative brokers you will need to supply a copy of your claims experience.

Claims experience can be notoriously difficult to obtain from your holding broker, as with any business, they tend to hold back before supplying it or supply inadequate copies in attempts to buy themselves’ time before your renewal giving alternative brokers little time to obtain terms.

It’s standard ploys you will experience everywhere unfortunately, however we like to market ourselves ensuring you truly do obtain the most competitive terms available to you, without the need to look elsewhere.

What is claims experience, and what does it look like?

When it comes to fleet many clients tend to stay loyal with their existing broker, which is to be applauded, as loyalty can be somewhat scarce in the insurance industry, however loyalty does often get renewed when it comes to annual premiums.

In the event that you feel that you could be over paying for your insurance you’ll want to start getting alternative quotations (from Goldcrest of course), but will undoubtedly face the aforementioned problems – so what is it you are actually looking for when requesting a copy of your claims experience?

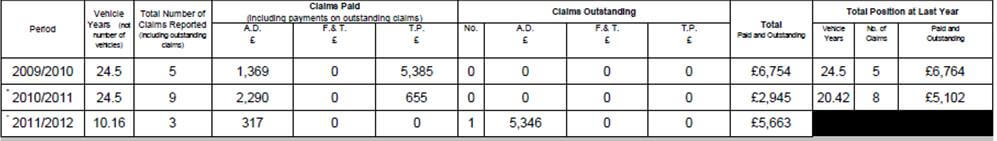

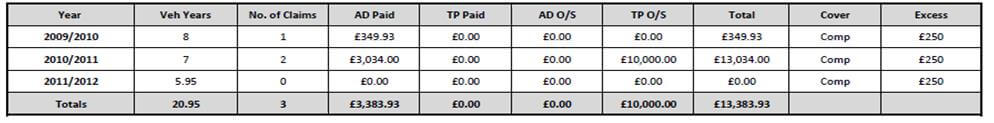

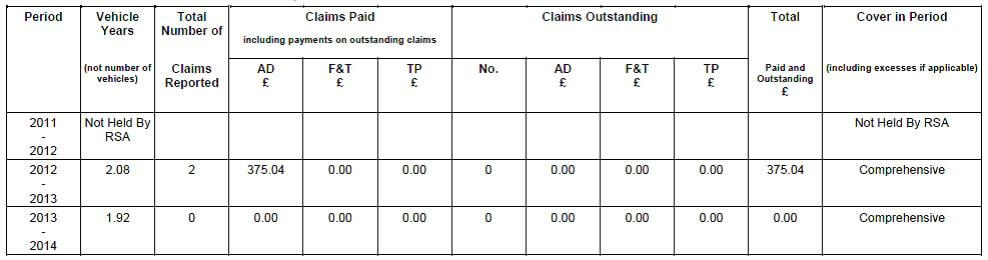

You will want an official document that has been processed by your insurer not your broker that reads like the following:

When obtaining a copy of your claims experience you will need to supply details within the last 3 years, but if you can provide copies over a longer duration it will only help the cause.

For any years with large losses, it also helpful if you obtain the claims listing; details of the events, who was driving etc.

Upon receipt of your claims experience along with additional details such as company info, list of vehicles etc. we would then tender looking to obtain the best possible terms available.

Understanding your claims experience

Getting your claims experience can look like a spreadsheet of jargon however it’s pretty easy to understand, and is also a useful tool in grasping how your fleet is actually running and make you proactive in running your vehicles/drivers more efficiently.

Vehicle years: Number of vehicles insured under the policy calculated on a pro rota basis, this is calculated from the policy’s inception up until a few months prior to renewal, taking into account also vehicles added on midterm.

Claims reported: the number of claims notified during the period of insurance

Claims paid: losses paid by your insurer

Claims Outstanding: Pending claims outstanding/under dispute; the amount listed here is either the predicted pay out or the worst case scenario figure usually calculated by the insurer’s claims department or solicitors.

AD: Accidental Damages – fault losses resulting in own damages

F&T: Fire & Theft – losses resulting in fire or theft of own vehicles

TP: Third party – losses resulting in damages to third parties

The larger the figure in “total” the higher your insurance premium will be, so you will need to keep this to a minimum to ensure you not paying huge premiums on your insurance.

When your fleet insurance falls due for renewal call our fleet department on 02084407400 to ensure a full market exercise we would usually suggest that a 7 day period is allowed upon receipt of the claims experience, though we are more than capable of working to short deadlines.